Properly applying taxes and discounts is essential for accurate estimates. Here’s how to manage these elements in VoltPro.

Adding Taxes to Estimates

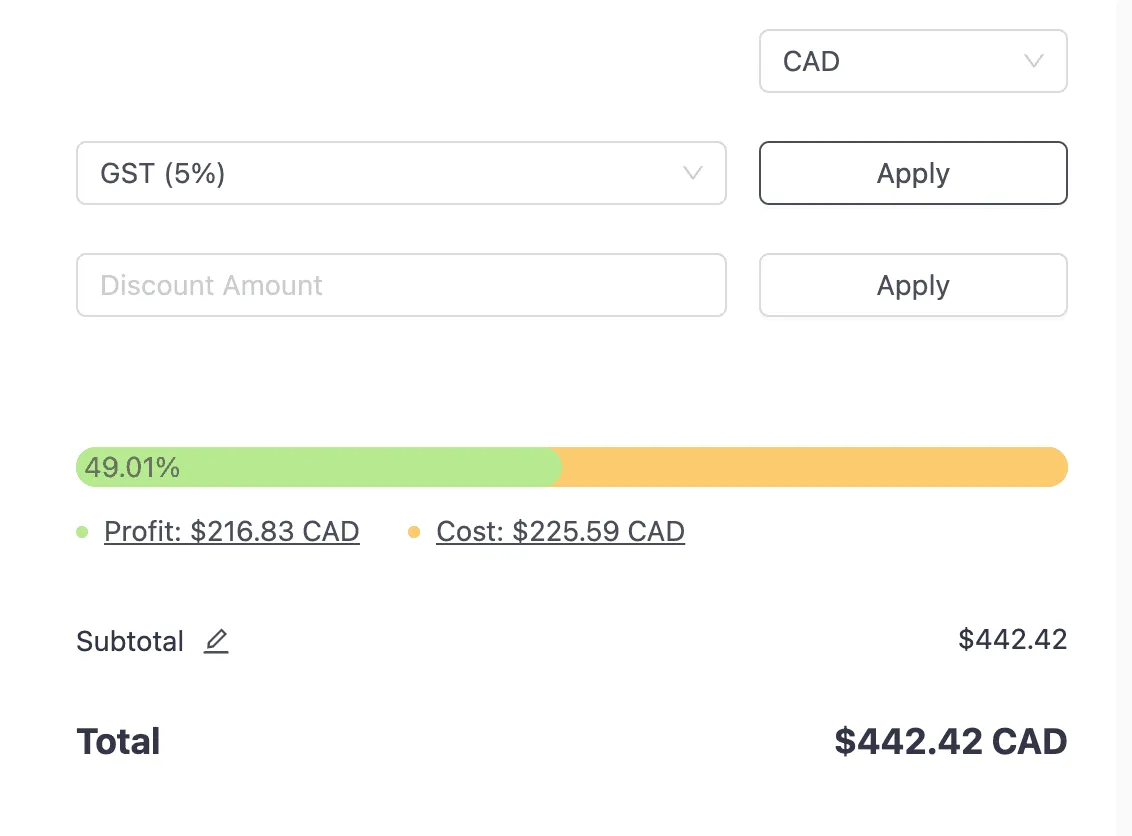

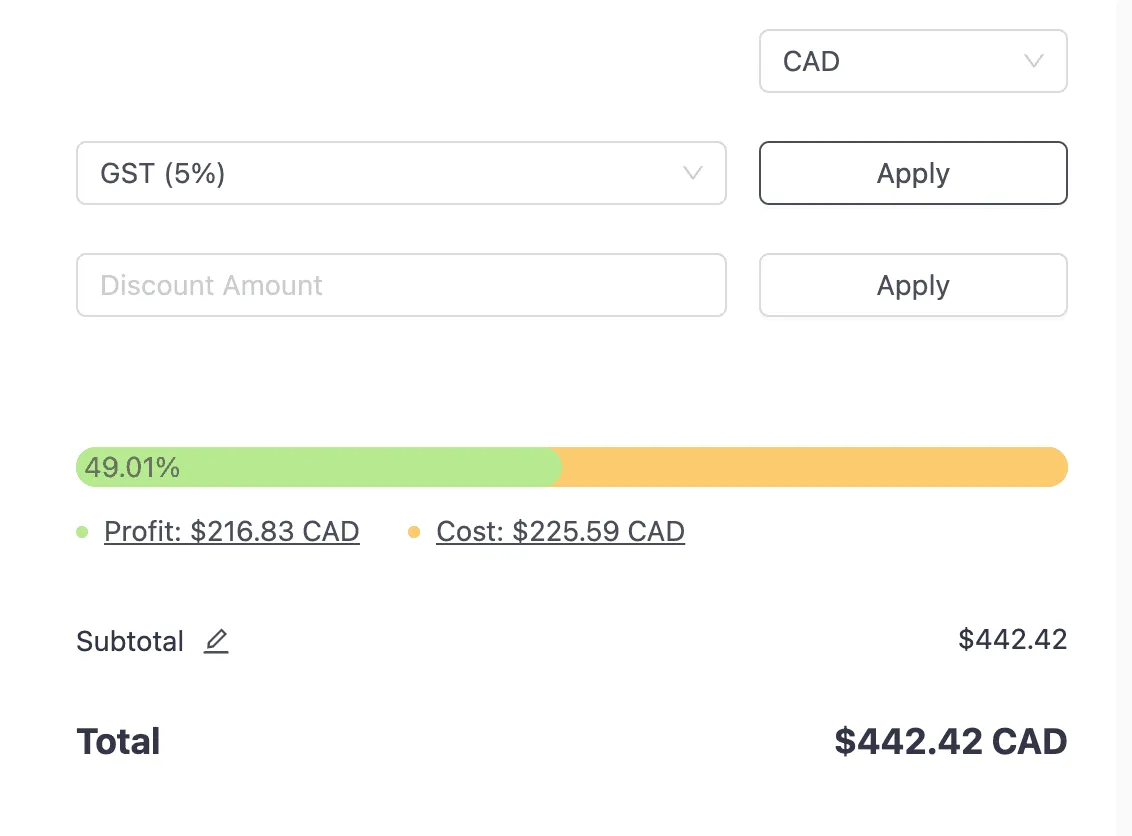

- When creating or editing an estimate, locate the tax section on the right side of the totals area.

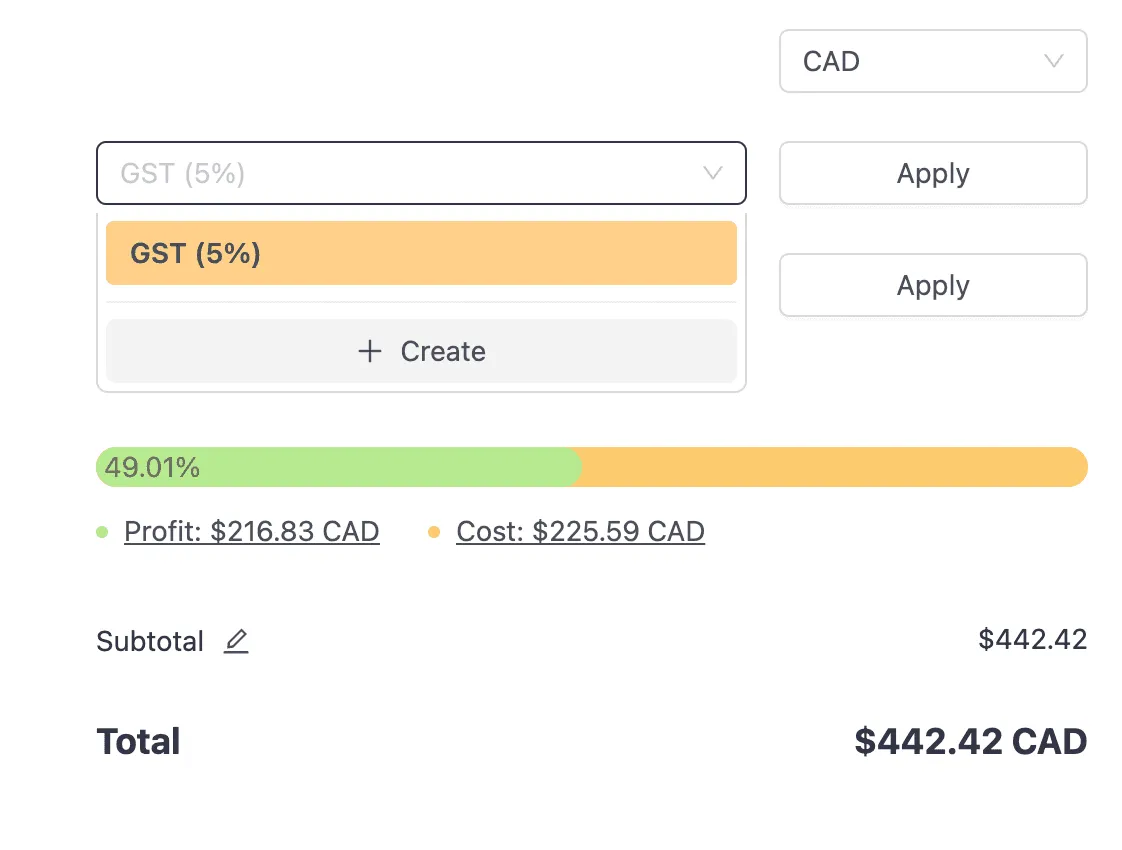

- Click the tax dropdown menu to see available tax rates.

- Select the appropriate tax from the dropdown (e.g., GST, Sales Tax, VAT).

- Click the “Apply” button to add the selected tax to your estimate.

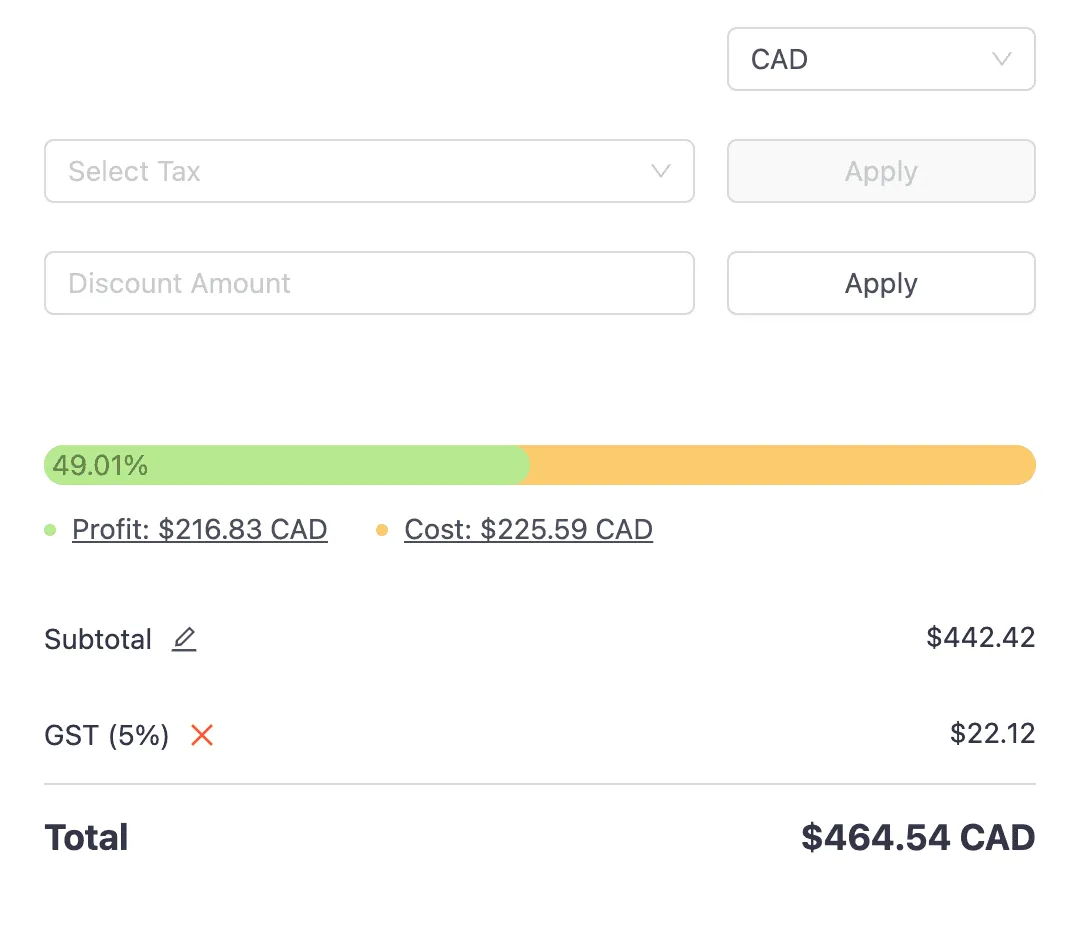

- The system automatically calculates the tax amount based on the subtotal.

- You can add multiple taxes if needed (for regions with multiple tax types).

Creating Custom Tax Rates

If you don’t see the tax rate you need:

- Click the ”+” icon next to the tax dropdown.

- In the “Create Tax” drawer that appears:

- Enter a display name for the tax (e.g., “County Tax”)

- Enter the percentage rate (e.g., “5.5”)

- Click “Create” to add this tax to your organization’s tax options.

- The new tax will now appear in the dropdown for selection.

Removing Applied Taxes

- To remove a tax from an estimate, locate the tax in the totals summary.

- Click the “X” icon next to the tax you want to remove.

- The system will recalculate the estimate total without this tax.

Applying Discounts

- In the estimate form, find the discount field near the tax section.

- Enter the discount percentage you want to apply (e.g., “10”).

- Click the “Apply” button.

- The system will calculate the discount amount based on the subtotal.

- The discount is applied before taxes are calculated.

Removing Discounts

- To remove a discount, locate the discount line in the totals summary.

- Click the “X” icon next to the discount percentage.

- The system will recalculate the estimate total without the discount.

Understanding Tax Calculations

- Taxes are always calculated after discounts are applied.

- The tax calculation formula is: Tax Amount = (Subtotal - Discount) × Tax Rate%.

- For multiple taxes, each tax is calculated separately based on the discounted subtotal.

- The final estimate total includes the discounted subtotal plus all tax amounts.